Verified by Visa Card 3D Secure

Identity theft is something that people worry about, especially when dealing with high risk commerce. You want to have a credit card 3D secure and reliable when you need it. International commerce and currency exchange need to have the safest options available. You may have heard about Verified by Visa, and it is an amazing service.

A Better Look At Your Visa Card 3D Secure

Verify 3D cards look really amazing, and it is hard to tell by that card the background of security in it.

With 3D Secure, there is an added level of security for both cardholders and merchants alike. One con regarding 3D Secure is that the cardholder may forget his/her password or get confused when filling out the forms, which may discourage them from going through the trouble of buying from your business. It should be noted, that in some countries and in some types of business, the use of 3D Secure is mandatory.

How it works

3D secure is also known as “Three Domain Secure” The category is as follow:

Retailer’s bank

Cardholder’s bank

3D Secure supportive infrastructure

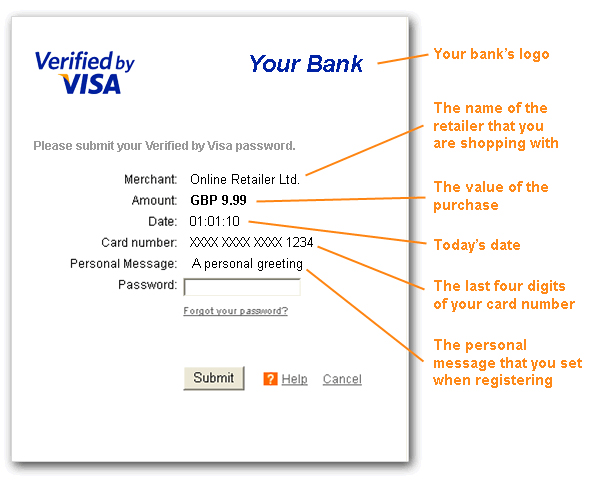

If your website participates in 3D Secure, when the cardholder completes the checkout process, he/she will be redirected the bank’s website and asked to provide a previously set up password (or he/she will be prompted to set up the password) and it will be verified by Visa or MasterCard

Unfortunately, not all card types are supported for 3D secure. Safe key is the authentication system used by Discover and American Express – this is not available in all countries, just UK and Singapore.

Cardholders have the option to opt out of making a 3D secure payment, but if they opt out more than 3 times, they may not be able to make purchases until they enroll in 3D Secure.

With Visa, you may decide whether to process a transaction that has had an incorrect password entered and you will still be protected from chargebacks since an attempt was made to authenticate the transaction with 3D secure. The same protection is not offered with MasterCard’s services.

3D secure timeout is a feature that really protects the consumer from others lifting their information. The 3D secure password also makes it very difficult for a would be criminal to steal your data.

You are able to you this service through a virtual terminal for terrific accessibility.

3D Secure Pros & Cons

Pros

Shift in liability–Instead of the merchant being responsible for the liability associated with chargebacks, the issuing bank will take control of the liability.

Chargeback protection –Visa offers the Verified service which guarantees no chargebacks to merchants. MasterCard does not offer this service.

Interchange benefits –These may allow longer payment terms and discounts at a lower rate with your acquiring bank.

Increased online shopping –With the increased security, customers feel safer about making charges with their credit cards online.

Cons

Some customers don’t like the confusion and extra step that enrolling in 3D secure requires. Some customers may just seek out another merchant that does not use this service instead.

With the billions of banking exchanges per day, there is no wonder that some credits exchanges get messed up in the process. To make matters worse, banks have been increasingly trying to lower their risk on merchant accounts. This has led to extra "verify protect" measures dealing with these accounts.

Orbit's complete merchant services is the golden standard for international banking solutions for risk management.

Get started today and fill out the application: [ APPLY FOR A MERCHANT ACCOUNT ]